The world always has faced problems, some seemingly beyond the human capacity to solve, yet we always eventually do and eventually we move forward. Over the long haul mankind advances but not without periods of serious retraction.

The Dark Ages were called dark for a reason, mankind regressed into a funk that lasted not just decades but centuries. Sure there were advances but all in all that period can not be considered a great step forward for the human species here on the blue planet. There have been others too, the history of the advancement of mankind is more an object lesson in fits and starts than some rolling tide of progress.

The main reason for this is that mankind is comprised of well ...humans and humans have not changed all that much really. Oh we have evolved through technology and advancement in education, but some of our basic characteristics remain pretty much as they were in the beginning, wherever you choose to start that beginning from.

Just a couple of quick examples here to make the point. Are humans less likely to be susceptible to greed today than they were in lets say Caesar's time? I doubt it but even if we are, greed is still very much with us. The same can be said for evil, Hitler and Stalin were by no means the last in the long line of evil characters that have populated the human experience since that unknown beginning of the human race. How about the not quite evil propensity of the power hungry personality? You might even know a few of those characters in your own life.

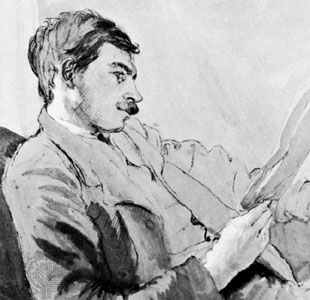

Whoever wishes to foresee the future must consult the past; for human

events ever resemble those of preceding times. This arises from the fact that

they are produced by men who ever have been, and ever shall be, animated by the

same passions, and thus they necessarily have the same results.

Machiavelli

The wonderful aspect of looking at the human experience over the historical scale rather than through just the lifetime experience, you are able to see the good and inspiring alongside the evil and destructive without emotional attachment to the here and now. But the most important aspect of the historical context, is we are allowed to see what works and what does not.

Although in the long run I believe that all things ultimately work for the good, after all the Dark Ages beget the Renaissance. The more we look to the past the less likely we are to make the mistakes of the past if we are willing to learn from it. The problem of course is that too few learn and others think that

this time it will be different.

Those who cannot remember the past are condemned to repeat it.

George SantayanaThe other night I was watching television and suddenly I was awe struck by the commercials. There was nothing unusual, the typical luxury car, cell phone, delivery service, fast food fare one typically experiences on an evening television viewing. What struck me was how amazing it was that all this stuff was part of the human experience today.

Just for a second put yourself at the turn of the twentieth century and what your life would consist of compared to today. The advancement of human achievement boggles the mind in a mere century of time. In two generations, actually less we went from the horse and buggy to the moon and from the telegraph to the world wide web.

We can argue the good and the bad of any or all of these advancements on the human experience but one thing we can not argue is the tremendous accomplishments of it all. I tend to believe that technological advancements ultimately work to the good of mankind. But here is the point, at least one of them.

What was responsible for this tremendous advancement? Was it socialism? Next time you pick up your cell phone to make a call, ask yourself, did socialism create this? Of course it didn't, nor the automobile you drive, the computer you read this on , the countless necessities and luxuries we enjoy and use on a daily basis are not the product of socialism or communism, they are undeniably the product of capitalism, pure and simple.

Ask yourself, what great technological, engineering, medical or any other significant accomplishment can be directly attributed to a socialist system of government? It is true that when a socialist form of government reaches the stage of

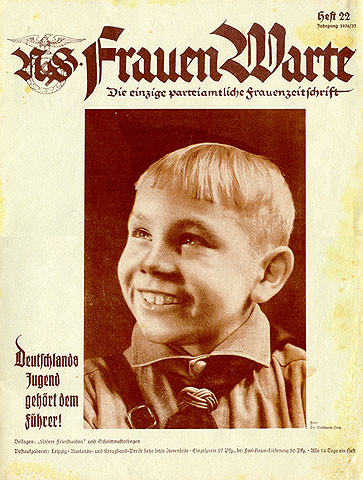

totalitarian as they must ultimately do to continue, brute force can mandate certain accomplishments. After all Hitler gave us the foundation for the space program and his was a quasi-socialist society.

Yet here we are in America of all place flirting with socialism, heck we are beyond the flirtation stage, we are into serious foreplay. We have watched over the decades as socialism in almost every form has shown itself to be totally inadequate to meet the needs of a society.

Everyone knows why this is, socialism does not account for one of man's most basic instincts, the need to achieve. It actually deprives men of that basic desire and stifles it. If a person is not responsible for his or her success or failure, if this is a product of the collective whole, then to be blunt why bother?

Why bother with the extra hours, the extra effort, when all your work is to be divided equally among your so called peers by authorities who determine what is best for society, as if they were some how divinely inspired to make such judgements.

“You Americans are so gullible. No, you won’t accept Communism outright; but we’ll keep feeding you small doses of Socialism until you will finally wake up and find that you already have Communism. We won’t have to fight you; we’ll so weaken your economy, until you fall like overripe fruit into our hands.”

Nikita Sergeyevich Khrushchev

The Soviet system collapsed because in the end any system based upon socialism can not sustain itself. However the lure of socialism and those who naively believe that you can eat its forbidden fruit without being poisoned by it persist. The poison of Socialism is simply this, "I am not responsible for myself." It is the path of the lazy.

Much was made of George Bush and his infringement on civil liberties with the Patriot Act which by the way passed the congress with overwhelming bi-partisan support. Often quoted by leftist know it all were the words of Benjamin Franklin.

Those who would give up essential liberty to purchase a little temporary safety deserve neither liberty nor safety

In truth, the path that we are being led down is far more in keeping with those words than any threat we face from previous external or internal forces. Lincoln suspended Habeas Corpus to save the Union, Woodrow Wilson jailed literally thousands of persons who opposed the "Great War" and of course Franklin Roosevelt interned an entire population of Japanese Americans in the name of National Security all without Congressional approval, yet we learned and vowed to watch for such abuses in the future.

Yet here we are willingly giving over our most precious gift as Americans, our liberty, piece by ever larger piece for the promise of safety, economic safety. When a person an institution or a business is not held accountable for its failure, but is rather absorbed or

rescued by the collective whole as is the process which we are increasingly engaged in, we will neither end up with safety or liberty.

Our founding fathers went to great pains to insure that this would not happen. The very essence of our Constitution is to protect the individual from the encroachment of a monolithic government. They warned over and over again in their writings that the power of government was not a good thing but as Thomas Paine cautioned:

Government, even in its best state, is but a necessary evil; in its worst state, an intolerable one.”

The path that we are following is leading from the necessary evil to the intolerable for any person who considers liberty to be the divine right of man, which is not a religious proposition but a historic and political reality.

Recently I was accused of not keeping up with the times, that somehow my views were outdated. As is the case with much of the liberal nonsense espoused as being enlightened, it is the opposite. I do not wish to hold onto the past out of some traditional reverence, I want to protect the future for further generations. The idea that giving up a bit of personal freedom for a larger good is not enlightened, it is oppressive and ultimately destructive.

We will overcome these times, human history is one of advancement, the only question is will we take a step back into the dark in order to more clearly see the light.